User Research: How to Collect, Organize & Share Qualitative Data

Incremental improvements are what make businesses sustainable.

Failing to fix a problem your customer is struggling with means they’ll churn. Even worse: those long-term habits of failing to meet expectations can impact profitability. You’ll be missing out on customers ready and willing to give you their money if it’s hard for them to do so.

The only problem? Figuring out what needs changing, and prioritizing those actions, isn’t as simple as you might think.

It boils down to good user research: knowing exactly who your customers are, and what they want (or don’t want.)

In this guide, we’ll share:

- What UX research is

- The differences between qualitative vs. quantitative data

- Why user research is important

- The 3 stages of qualitative user research

- How to find participants for user research

- The user research questions you should be asking

- How to take and organize UX research notes

What is UX research?

Before we dive into the way you can collect data about your users, let’s be clear on what user research actually is. Here’s a simple definition:

User research is a series of research methods that aims to find out about your customer. The end goal is to use that research to create a product they engage with, purchase from, and continue using.

You can conduct user experience research for a variety of things. For example: you can use UX research to make your app more user-friendly. You could optimize your website to make it easier to navigate. Each of these things improves the end user’s experience with your product.

There are two types of research you’ll do to collect feedback: qualitative and quantitative studies.

Quantitative user research

Chances are, quantitative data is the first thing that comes to mind when you think of data. The end result of your research is figurative—all produce a numerical figure, such as percentages and ratios.

Quantitative research methods include:

- A/B testing

- Eye-tracking reports

- Heat maps

- Survey questions (like “rate this on a scale of 1-10”)

Qualitative user research

Qualitative research is different from quantitative. The end result is non-numerical, such as text, audio files, or video. The goal is to understand how/why people feel a certain way, or do a certain thing.

Qualitative research methods include:

- Survey questions (like “how do you feel about X?”)

- User interviews

- Usability testing

- Field studies

- Focus groups

- User behavior tests

In this guide, we’ll talk mainly about qualitative user research because it overcomes the Narrative Fallacy:

“We are inundated with so much sensory information that our brains have no other choice; we must put things in order so we can process the world around us. It’s implicit in how we understand the world.”

Working only from numbers (quantitative data) means you’ll automatically pull your own insights—even if the data doesn’t explicitly show that insight is accurate. Our brains are wired to add narratives to help us understand things (like rows of meaningless numbers.)

But our narratives aren’t always accurate. Past experiences impact how we see things. It’s why one data analyst can interpret quantitative data as something completely different from another analyst.

Key insights and reasoning behind a data point is obvious with qualitative data. You’ll collect feedback that explains why people do something, with that data coming from the horse’s mouth. There’s little color you need to add to fill their narrative.

The right qualitative research data means you’ll know exactly why somebody feels a certain way, buys a certain thing, or engages with a product. No guesswork needed.

Why should I do user research?

Now we know what user research is, let’s take a look at why it should be a key part of business and product development.

Build a product your users love

User research has huge overlaps with psychology. Research can help uncover:

- What makes your customers tick

- The pain points they’re solving when buying your product

- What would steer them away from buying

The more you know why a person behaves a certain way, the better you can build a product around that.

You’ll uncover what they actually need (rather than just what they want)—a valuable insight that’ll help make sales and marketing 10 times easier. You’re playing to something a person has a genuine need to buy; not something they need to be convinced they even need.

Nail your marketing and advertising

Buyer personas are the foundation of any marketing or advertising strategy.

Interestingly, it’s a key part of user research. You want to figure out the needs, wants, demands, habits, and preferences of someone who would buy your product. Each of that research means you can tweak your tactics to reach them.

Remove the risk of huge updates and pivots

You can spend years building the wrong product if user research isn’t a main part. But if user research is a focal point throughout your building stage, you’ll catch any huge mistakes being made that can be timely and expensive to rectify.

User research ties into conversion rate optimization, too. A solid understanding of what your customers do and don’t like means you can prioritize changes that’ll have the biggest impact on your bottom line.

Let’s say you’re optimizing UX on a website, for example. A lack of user research data doesn’t tell you that most people stop buying because of a lack of social proof at your checkout. So, you prioritize another test on the color of your call to action buttons.

Had you been given those insights beforehand, you’d have done the social proof testing beforehand—and got more conversions in the meantime.

The 3 stages of qualitative UX development

There’s more to user research than sitting with your customers and asking them what they do (or don’t) like.

Nielsen Norman categorizes the entire UX development process into three main stages. Let’s take a look at the research methods used at each stage.

1. Strategize

The first stage of user research is conducted before planning a new product, update, or launch. You’re collecting background information about your customers and how your product might slot into their lives.

The following UX research methods will be useful at this point:

- Collect internal feedback: Ask your team to submit their feedback on what your strategy should look like. You can do this through simple tools like Google Forms, Typeform or SurveyMonkey.

- Attitudinal research: Figuring out what customers think or believe about a certain thing. You want to find out their attitudes towards something.

- User persona research: Learning about the person most likely to buy your product, including their demographics, interests, and behaviors.

- Diary studies: Asking users to document a day in their life. You find out what activities, thoughts, and tasks they complete throughout the day.

2. Execute

By the second stage, you’re making the first few variations of a product or update, or prototyping, but you still need feedback pre-launch.

Use the following research methodologies to help:

- User interviews: Sitting down with your target customer and asking direct questions one-on-one.

- Field studies: Going to a place where you plan on selling your product or reaching your target customer, and asking them questions whilst they’re actively in that context.

- Card sorting: Asking people to organize cards into groups. This technique is most used for clarifying information architecture. You’ll find out how people sort, organize, and categorize information.

- Usability tests (user testing): Giving a prototype of your product to somebody and monitoring how they interact with it. You can ask for their feedback on why they’ve completed each action.

3. Assess

Just because your new product or update is out in the wild, it doesn’t mean testing ends.

Use the following research methods to to see what people think about it—and what you can improve:

- Customer surveys: Going directly to the people who’ve purchased your product and figuring out why they did, and how the sales process looked for them.

- Social media analysis: Diving into notifications, and using social listening tools like Mention to eavesdrop on what people are saying about your product, feature, or brand.

- Website feedback forms: These online surveys help understand weak points on your website—like “what stopped you from purchasing today?” or “what information can we give you that you’re looking for?”

How to find participants for qualitative research

You can have knowledge around user research and the methods you need to do. But without the right people giving you that data, you’ll struggle.

It’s difficult to generalize how to find participants for research. The people you’ll need to collect qualitative data from depends on the stage of user research you’re in, and the data you want to collect.

The key is to get creative. Think about your target audience or customers and what their day-to-day life looks like, and meet them there.

If they spend Saturday mornings shopping with their kids, head to the mall and ask people to take part in your user interviews. If they’re B2B buyers spending time on Twitter, use advanced search features to find people who fit that mould.

One underrated tactic is to look at the qualities of your existing customers. These are people who’ve already bought from you. Chances are, you want to capture new people with similar interests. Lookalike audiences within Facebook Ads make a new list of people with similar qualities. Target those people, asking them to take part in your research.

But remember how we said the methods used to find participants depends on your stage of user research? People needed for post-launch data are entirely different: you want to find people who’re actively using the product. You want their feedback to improve. So, ask website traffic and leads (who’ve entered their email address) to take part. They’re actively using your product and can speak about potential updates.

What should I ask in user research interviews?

User interviews are superb methods of research because they’re hugely adaptable. You can tweak the questions and use the same method at each stage of the research development process.

The best part? Getting face time with your user allows you to observe what they do, not just what they say. There’s often discrepancies between what people say and how they actually act. You want the truth: that lies within natural behavior.

Again, the questions you ask depend on the type of data you want to get. Below are seven generic starter user interview questions to ask:

- What does a typical day look like for you?

- On first impression, what do you think this product does?

- Can you describe how you’d usually solve [pain point]?

- What’s the most difficult thing about using this product?

- What information would convince you to purchase this product?

- What would you change about this product?

- How much would you be willing to pay for this product?

Remember: the key is to ask standardized questions to start an interview, but listen and adapt based on the customer’s answers. Follow them down rabbit holes to collect more insight on things you might not have thought about.

Wherever possible, try to conduct these interviews alone. The Solomon Asch Conformity Experiment proves that people will follow the lead of the group, even if the decision is contradictory to what they believe themselves. You’ll get more honest feedback from each user research session if others around them don’t subconsciously influence their opinions.

How to take and organize UX research notes

As you go through your own user research, you’ll be bombarded with information. Failing to make use of that information (or storing it incorrectly) makes it easy for your efforts to be wasted.

Here are five techniques you can use to take, organize, and share UX research notes. You won’t forget about your data, nor leave it to go unused, again:

1. Find a UX research tool

A worker is only as good as their tools. The same applies to UX researchers.

Unorganized notes jotted down sporadically in an old notepad probably won’t be seen again. Spreadsheets need lots of manual coding and formatting; manual data analysis takes brainpower you don’t need to be wasting.

Adding them into a UX research tool designed especially for organizing notes you’ve made from user research sessions does the opposite.

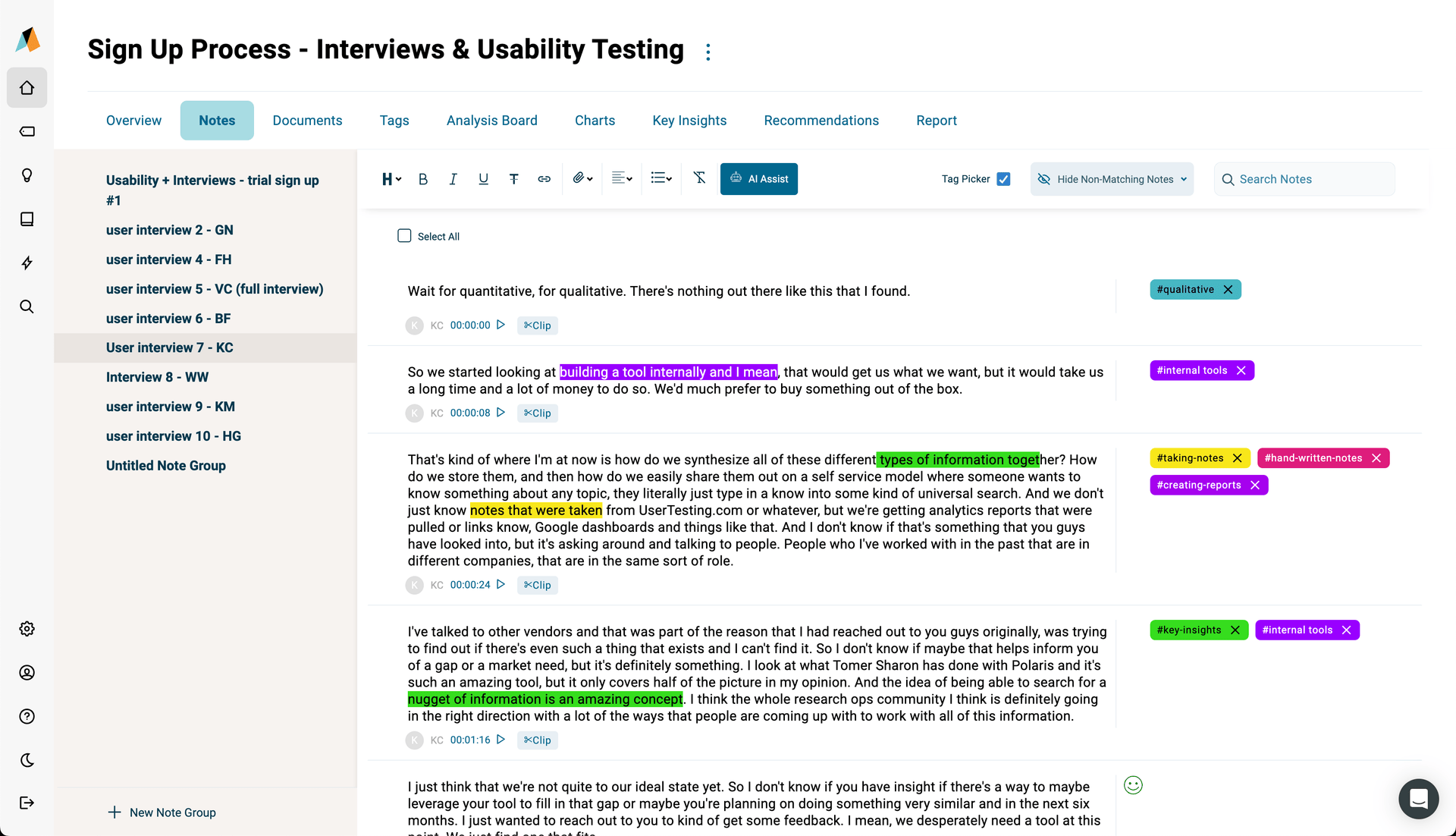

A tool like Aurelius can store and organize your UX research notes. It’ll make it so much easier to pull that data into insights (and then into recommended actions.)

2. Take research notes

You should be taking notes at every user research session. Jotting down important things about your conversations helps you find common themes. That’s where the value of user research lies.

Head to your UX research tool and create a new project each time you run a new round of tests. Make notes of what your user talked about—no matter how small or irrelevant you might think they are at first glance. You’ll start to notice common themes in smaller insights. That’s what helps you move the needle with user experience: making small, subtle changes that your customers tell you they want.

Try to make sure your note-taking is consistent. You’ll be referencing these notes when it comes to analysing several rounds of research. The goal is to make them easy to understand when you (or someone else on your team) comes back to them.

Mason Culligan explains how they do this at Mattress Battle:

“I prefer to have a consistent style in taking notes for my UX research. Before starting, I have used a point-form style and a first-person perspective when taking down notes. It helps me to classify the data I gathered.

For example, a participant says, I love hiking, and I travel with my family twice a year. I put in my notes in bullet form, love camping, travel with family twice a year. It helps me capture the verbatim and not introduce bias in the data.”

In Aurelius, you create notes several ways:

- Uploading data from a spreadsheet

- Copy and pasting from any text file (such as Google Docs or Microsoft Word)

- Creating notes directly as you conduct the research

- Using Zapier integrations that pull data from other tools like SurveyMonkey, Google Forms, etc.

Regardless of which you’re doing, making sure your UX research notes are easily accessible and easy to understand. It’ll stop your data from going to waste.

3. Tag common themes

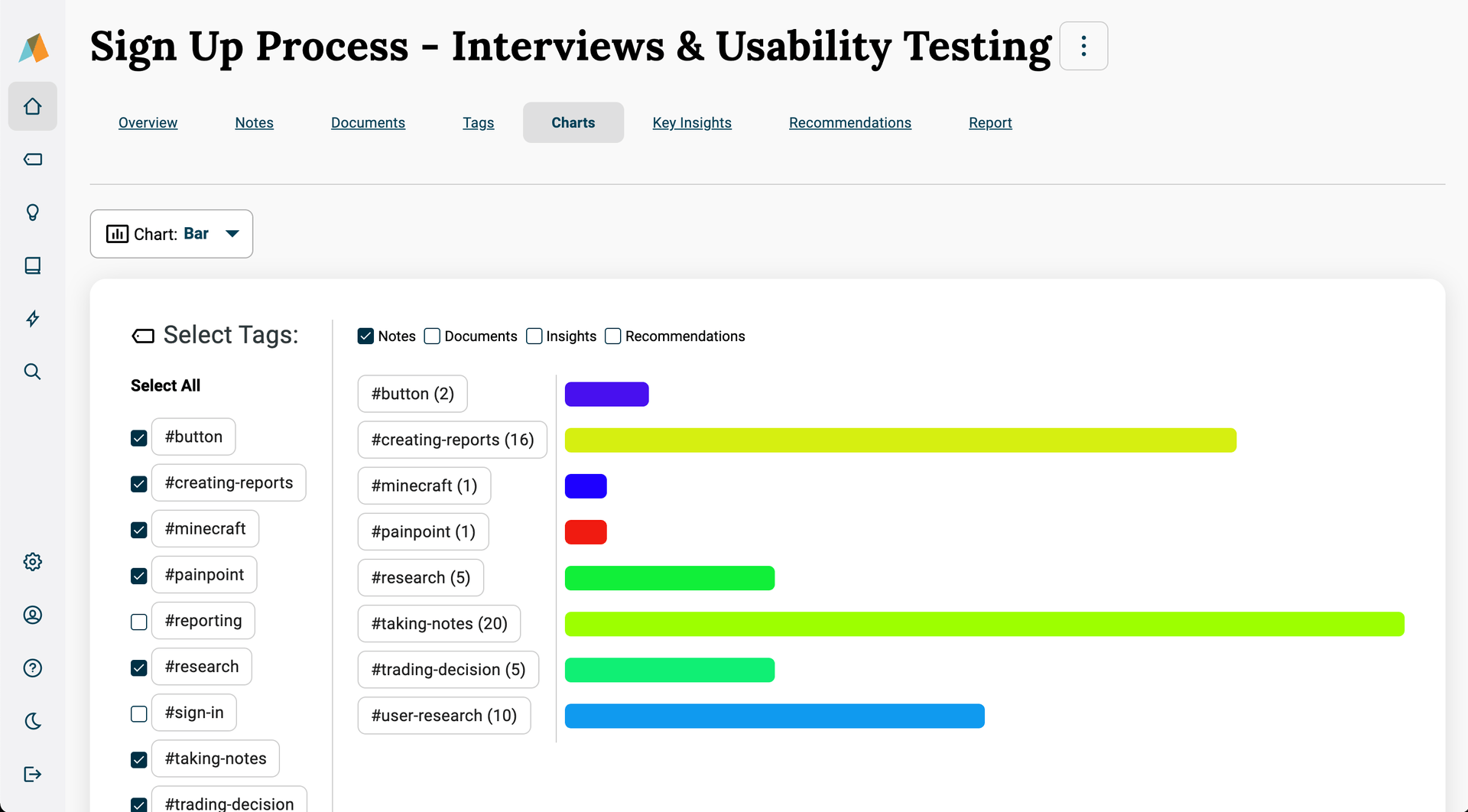

You’ve got your notes stored inside your user research tool. Next, you’ll want to tag them with common themes. It’ll help you sort data into themes, trends, and patterns—known as thematic analysis.

Thematic analysis finds patterns within qualitative data. But, you don’t need to do it manually. Most good user research platforms can tag data automatically, and pull common themes from it without much human intervention.

Aurelius, for example, uses intelligence to tag your notes. (You can do it manually though, if you’d prefer.) You can then search your entire user research project by tag to see all notes with that tag. It’s the simplest way to group and organize data so it can be found and reused again later.

4. Set file naming conventions for your notes

Projects, tags, and individual data points all need official file naming conventions. They’re rules that monitor how your data is named.

Making these file names consistent helps you find it again. For example, if some user researchers include hyphens in tags and others don’t, you’ll have two tags for the same thing. How will you know which one contains the data you’re looking for? You don’t—unless you scan through all of your notes under each tag.

Take some time to set file naming conventions, and encourage everyone on your UX research team to use them. That could be:

- Projects have “Q[number]—[year]” in the name (e.g. “Q2—2020”)

- All tags use hyphens

- Never creating tags for customer names within your data

5. Find and share key insights

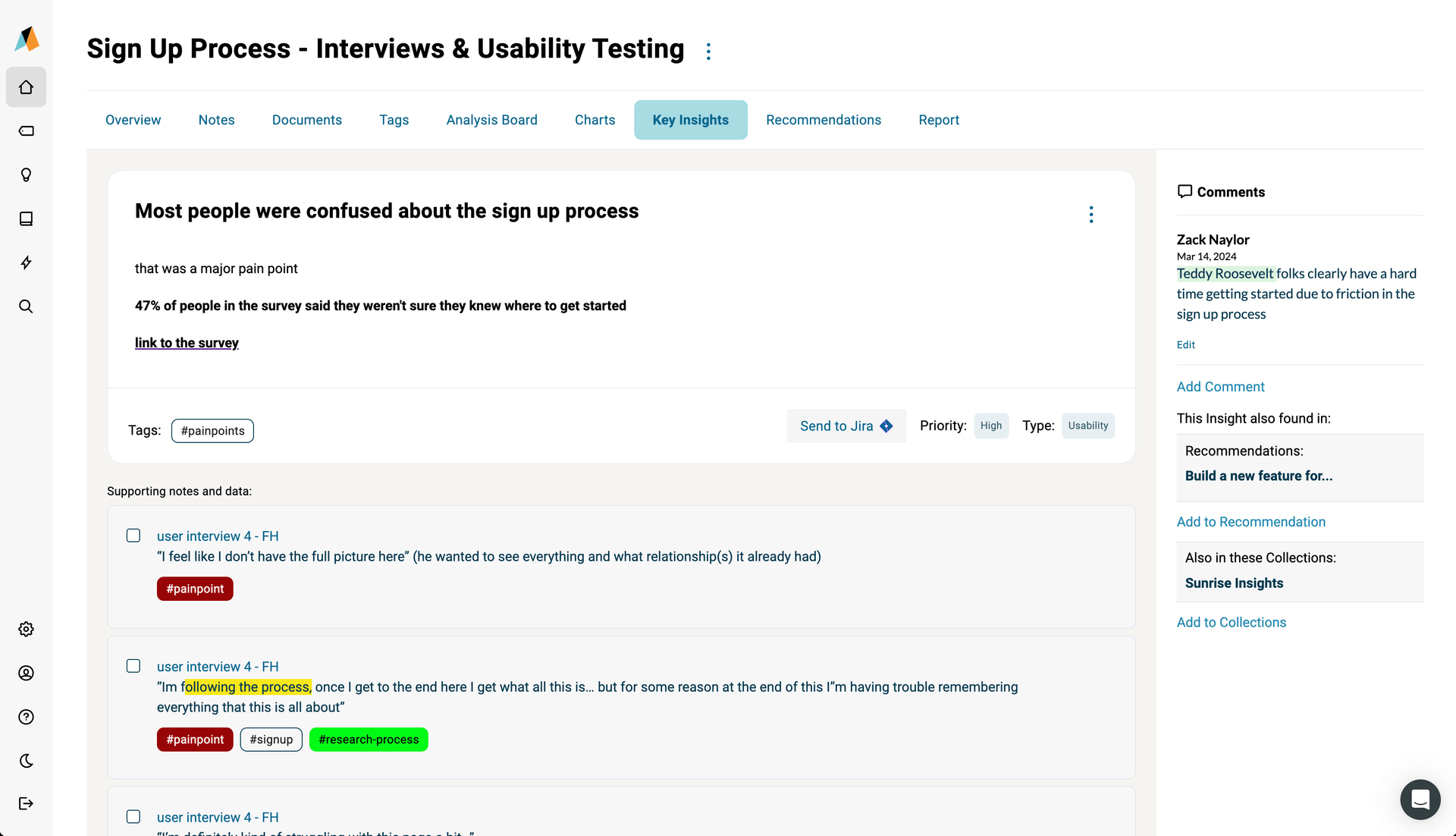

Once you’ve found common themes from a round of UX research, use the data to pull key insights. These are broader things you’ve learned from your research, based on the notes you’ve taken.

Oliver Andrews explains:

“Key insights or UX nuggets are those things you share to communicate what you learned from user research. Key insights are the answers to the questions that your user research project asked.”

To create one, gather data that indicates the thing you’ve concluded. This can include sentences from user research sessions, takeaways from focus groups, common denominators with diary studies—anything you’ve found from your research.

Use all of those data points to create one key insight such as:

- “Most customers buy this product because ABC”

- “Customers are more likely to buy if XYZ”

- “Our potential customer is looking for our products at X time of day”

Creating key insights inside your research tool helps you easily find data. You’ll have a streamlined way to find answers to questions like, “Do we know what people think about X?”

Over time, you’ll start to build your own central research repository. It’s a library of all the research you’ve done, and the insights you’ve pulled from it. Each team member can hop in and see the data you’ve found.

6. Suggest recommendations

Key insights form the basis of any action. With these recommended actions, you’re saying “because we found this insight, we recommend doing this task.”

Create recommendations directly inside your research tool by including a statement and description, and a tag for the notes to pull through. It helps you say “this is what we should do, and here’s the evidence to back it up.”

You can send these recommendations directly to your product managers/engineers via JIRA. (Or, send key insights to (or project management integrations using Zapier, if that’s easier to manage. Your premade workflows or templates can be used to action each insight.)

Finally, add a status to show what you’re doing with each recommendation. Highlighting each suggestion as in queue, in progress, or complete shows what your UX team has done over any given period—making it easier to prove UX research’s value to your stakeholders and wider team.

The best part? Out report builder means you can create a research report from your project automatically with all the key insights and recommendations you made on your Aurelius project. You’ll be able to edit and design it however you want, and share it as a link or PDF—all without leaving Aurelius. Talk about making UX research easier.

Conclusion

There’s no doubt that qualitative user research is important. But it’s not just what notes you collect that’s important. The way you analyze your data is just as critical.

So, are you ready to make your user research easier to keep track of—and research data easier to turn into actions that really move the needle?

Grab your 30-day free trial of Aurelius and get access to all of the features we’ve mentioned here.

You’ll soon start to wonder how you managed user research projects before it.